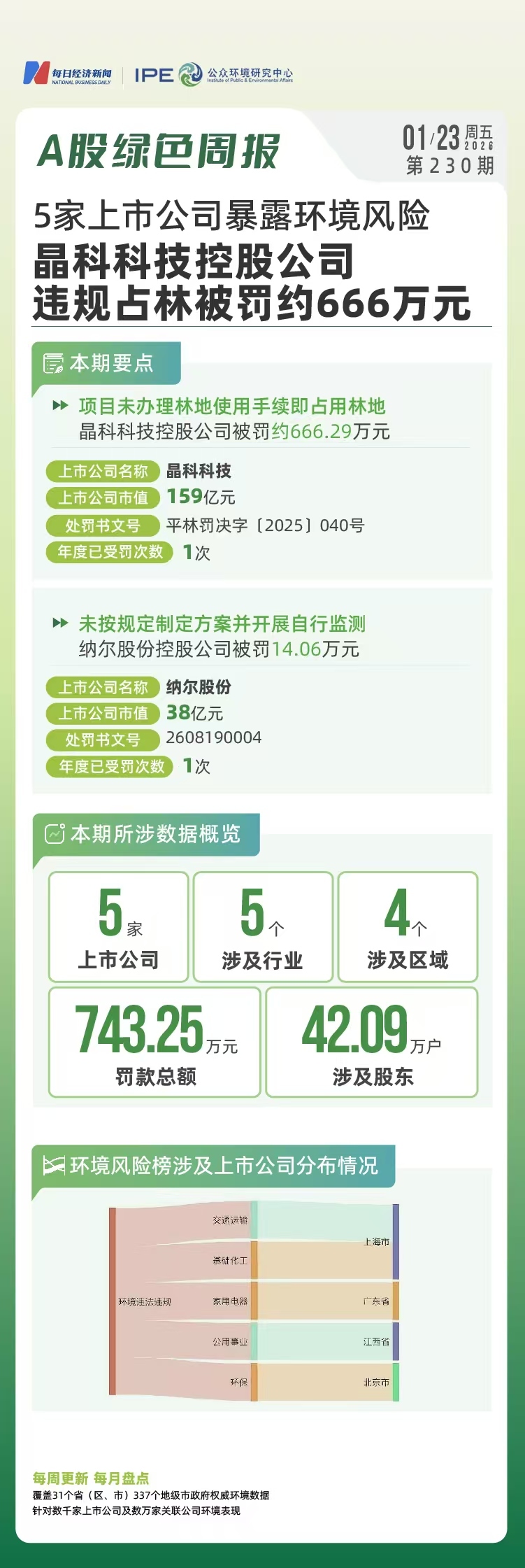

Blue Map Green Financial Database

Link listed companies with their affiliates to quickly obtain relevant environmental regulatory records, on-line monitoring data, enterprise feedback and emission data by searching the names of listed companies, stock codes and related companies names.